蜗牛博客VNPY学习记录:

VN.PY 2.0学习记录一(如何回测)

VN.PY 2.0学习记录二(策略开发)

Vn.py学习记录三(米筐教程)

VN.PY 2.0学习记录四(多线程、多进程)

Vn.py学习记录五–交易时间段及Widgets

Vn.py学习记录六(无界面模拟盘)

Vn.py学习记录七(V2.0.5版本)

Vnpy学习记录八(R-Breaker及pickle)

Vn.py学习记录九(事件驱动引擎)

VN.PY学习记录十(源码概述)

VNPY学习记录11(微信+Vscode)

VNPY学习记录12(父子进程、回调函数)

VNPY学习记录13(部署到云服务器,实现自动交易)

一、策略介绍

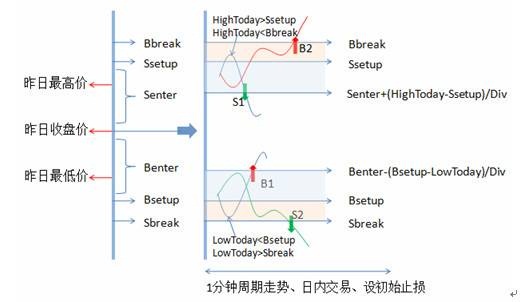

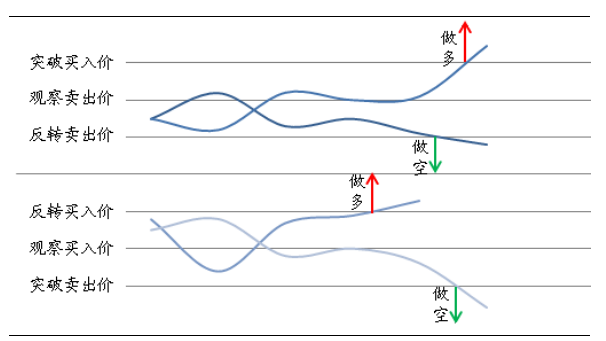

日内策略大都以固定价格为参照系,根据前一个交易日的收盘价、最高价和最低价依次计算出六个触发条件价位:昨日收盘价之上趋势情况下的突破买入(Bbreak),震荡冲高回落情况下准备卖出(Ssetup)和反手卖出(Senter)。昨日收盘价之下依次是反手买入(Benter),准备买入(Bsetup),突破卖出(Sbreak)。

为方便起见现只看多头交易。空仓时突破Bbreak开多,类似于突破昨日高点的菲阿里四价策略,区别只在偏移量。持仓时冲高回落,此时的仓位来源有两种情况,一是空仓突破买入后来回落到Bbreak以下,变成持多仓冲高回落;二是在空头反手开多后冲过昨日收盘价的持仓。实际测试中发现反手没有比单独平仓在胜率次均方面优秀,所以反手可以直接变成平仓。于是在昨日开盘价之上就两种情况:突破成功和突破失败。突破成功另外处理当然可以使用均线系统的出场条件,具体方法待以后研究。突破失败实际上变成以突破买入价开仓反手卖出价止损。由此可以看出R-Breaker只能是一个纯粹的日内策略,如果隔夜交易结果一定难看,原因很简单,止盈幅度太小,属于吃苍蝇腿的策略,追求蝇头小利。

显而易见,R-Breaker策略基本上没有新颖之处,胜率一般,实质上是一个菲阿里四价,而且止损幅度小于菲阿里四价,菲阿里四价的止损点在收盘价之下。至于具体的细节,了解即可。

参考:https://blog.csdn.net/S_o_l_o_n/article/details/81366884

根据前一个交易日的收盘价、最高价和最低价数据通过一定方式计算出六个价位,

从大到小依次为:

突破买入价(buy_break)、观察卖出价(sell_setup)、

反转卖出价(sell_enter)、反转买入价(buy_enter)、

观察买入价(buy_setup)、突破卖出价(sell_break)

参考:https://www.sohu.com/a/119798483_505915

生成K线:https://blog.csdn.net/q275343119/article/details/85165752

二、pickle

将数据保存为pickle,方便以后调用。

import pickle

data = [0, 1]

# 保存

with open('day.pickle', 'wb') as f:

pickle.dump(data, f)

# 读取

with open('day.pickle', 'rb') as f:

b = pickle.load(f)

print(b[1])

三天的:

import pickle

data = [0, 3, 0]

# 保存

with open('3day.pickle', 'wb') as f:

pickle.dump(data, f)

# 读取

with open('3day.pickle', 'rb') as f:

b = pickle.load(f)

print(b)

三、策略实现

import pickle

from vnpy.app.cta_strategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

from datetime import datetime, time

class RBreaker(CtaTemplate):

author = "蜗牛博客:http://www.snailtoday.com"

fast_window = 10

slow_window = 20

fast_ma0 = 0.0

fast_ma1 = 0.0

slow_ma0 = 0.0

slow_ma1 = 0.0

parameters = ["fast_window", "slow_window"]

variables = ["fast_ma0", "fast_ma1", "slow_ma0", "slow_ma1"]

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

""""""

super(RBreaker, self).__init__(

cta_engine, strategy_name, vt_symbol, setting

)

self.bg = BarGenerator(self.on_bar)

self.am = ArrayManager()

self.indicator1=0 #反转做空信号

self.indicator2=0 #反转做多信号

#用于记录当天最高价

self.dayMaxPrice = 0

self.dayMinPrice = 0

self.dayClosePrice = 0

self.threeDayPrice = [0,0,0]

self.DAY_END = time(15, 00)

self.DAY_START =time(9,30)

self.bb = 0

self.sw=0

self.bw=0

self.sa=0

self.ba=0

self.sb=0

self.bb=0

self.coeff_w = 0.35

self.coeff_a1 = 1.07

self.coeff_a2 = 0.07

self.coeff_b = 0.25

self.fixedSize = 1

def on_init(self):

"""

Callself.back when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(10)

def on_start(self):

"""

Callself.back when strategy is started.

"""

self.write_log("策略启动")

self.put_event()

def on_stop(self):

"""

Callself.back when strategy is stopped.

"""

self.write_log("策略停止")

self.put_event()

def on_tick(self, tick: TickData):

"""

Callself.back of new tick data update.

"""

self.bg.update_tick(tick)

def on_bar(self, bar: BarData):

"""

Callself.back of new self.bar data update.

"""

# 全撤之前发出的委托

#self.cancelAll()

# 保存K线数据

am = self.am

am.update_bar(bar)

if not am.inited:

return

#获取前一分钟的收盘价和最高价

min_1_close=am.close_array[-2]

min_1_high=am.high_array[-2]

self.f1 = open('break.txt','a')

self.__timeWindow(bar.datetime)

if self.openWindow:

#打开前两天价格记录文件,并导入为一个self.twoDayPrice的列表,self.twoDayPrice[0]代表前天价格,self.twoDayPrice[1]代表昨天

with open('3day.pickle', 'rb') as f:

self.threeDayPrice = pickle.load(f)

self.f1.write("-"*100)

self.f1.write('\n')

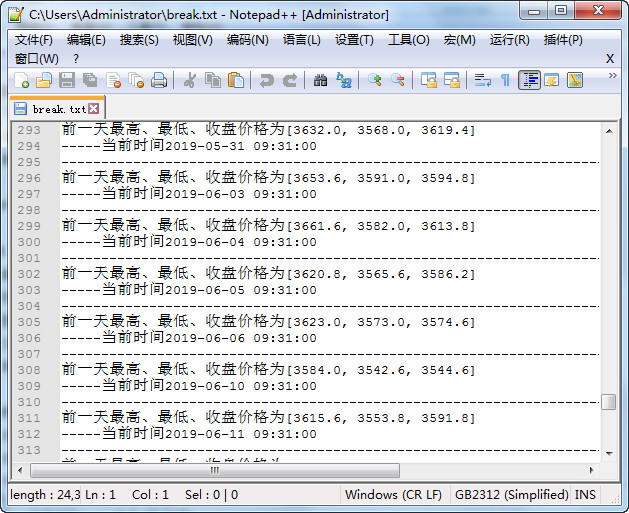

self.f1.write("前一天最高、最低、收盘价格为{}".format(self.threeDayPrice)+'\n')

self.f1.write("-----当前时间{}".format(bar.datetime)+"\n")

self.dayMaxPrice = bar.high_price

self.dayMinPrice = bar.low_price

#计算前一日最高价、最低价和收盘价

high = self.threeDayPrice[0]

low = self.threeDayPrice[1]

close = self.threeDayPrice[2]

#计算指标数值

self.sw=high+self.coeff_w*(close-low)

self.bw=low-self.coeff_w*(high-close)

self.sa=self.coeff_a1*(high+low)/2-self.coeff_a2*low

self.ba=self.coeff_a1*(high+low)/2-self.coeff_a2*high

self.sb=self.bw-self.coeff_b*(self.sw-self.bw)

self.bb=self.sw+self.coeff_b*(self.sw-self.bw)

if bar.high_price > self.dayMaxPrice:

self.dayMaxPrice = bar.high_price

if bar.low_price < self.dayMinPrice:

self.dayMinPrice = bar.low_price

# 判断是否要进行交易

##趋势

if min_1_close<=self.bb and bar.close_price>self.bb:

if self.pos==0:

self.buy(bar.open_price,self.fixedSize)

if self.pos <0:

self.cover(bar.close_price,abs(self.pos))

if min_1_close>=self.sb and bar.close_price<self.sb:

if self.pos==0:

self.short(bar.open_price,self.fixedSize)

if self.pos>0:

self.sell(bar.close_price,self.pos)

##反转

###多单反转

if bar.high_price>self.sw and bar.close_price>self.sa:

self.indicator1=1

if self.indicator1==1 and bar.close_price<self.sa:

self.indicator1=0

if self.pos>0:

self.sell(bar.close_price,self.pos)

self.short(bar.open_price,self.fixedSize)

###空单反转

if bar.low_price<self.bw:

self.indicator2=1

if self.indicator2==1 and bar.close_price>self.ba:

self.indicator2=0

if self.pos<0:

self.buy(bar.close_price,abs(self.pos)+self.fixedSize)

#当天平仓

if bar.datetime.time()>time(14,55):

if self.pos>0:

self.sell(bar.close_price,self.pos)

if self.pos<0:

self.cover(bar.close_price,abs(self.pos))

if self.closeWindow:

self.threeDayPrice[0] = self.dayMaxPrice

self.threeDayPrice[1] = self.dayMinPrice

self.threeDayPrice[2] = bar.close_price

#将最近一天的最高、最低、收盘价保存到pickle文件

with open('3day.pickle', 'wb') as f:

pickle.dump(self.threeDayPrice, f)

self.f1.close()

#发出状态更新事件

self.put_event()

def __timeWindow(self,dt):

"""交易与平仓窗口"""

self.openWindow = False

self.orderWindow = False

self.tradeWindow = False

self.closeWindow = False

self.afterCloseWindow = False

#用于获取开盘价

if dt.hour == 9 and dt.minute == 31:

self.openWindow = True

return

if dt.hour == 9 and dt.minute > 31:

self.tradeWindow = True

return

if dt.hour == 10:

self.tradeWindow = True

return

if dt.hour == 11 and dt.minute <= 30:

self.tradeWindow = True

return

if dt.hour == 13:

self.tradeWindow = True

return

if dt.hour == 14:

self.tradeWindow = True

return

#清仓时段

if dt.hour == 15 and dt.minute == 00:

self.closeWindow = True

return

def on_order(self, order: OrderData):

"""

Callself.back of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callself.back of new trade data update.

"""

self.put_event()

def on_stop_order(self, stop_order: StopOrder):

"""

Callself.back of stop order update.

"""

pass

参考:https://blog.csdn.net/tt07406/article/details/81988898

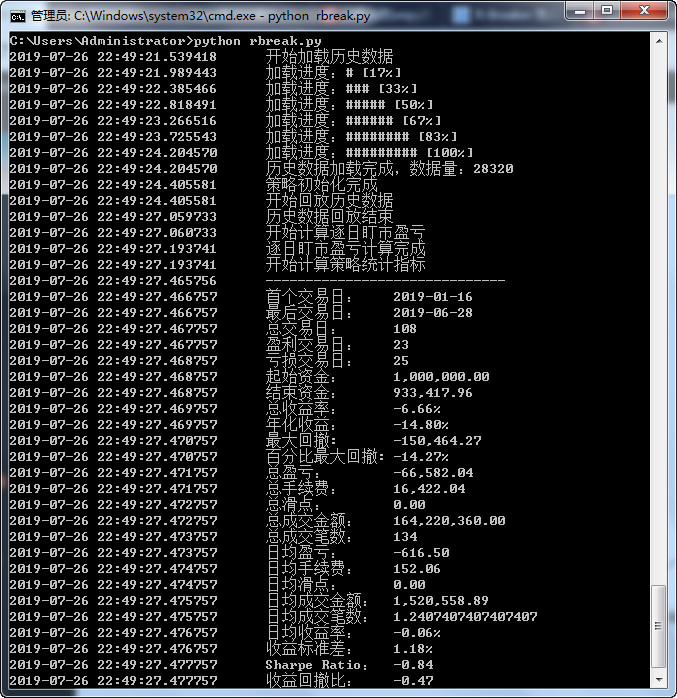

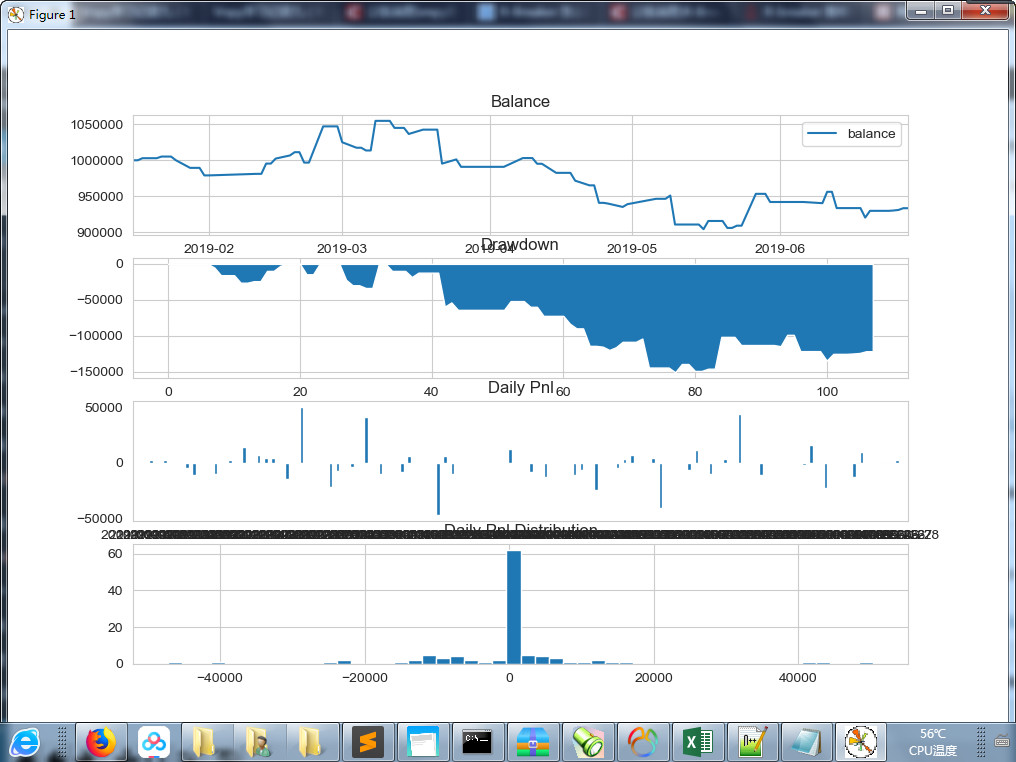

四、效果展示

五、获取前一天的OCLH价格

通过EXCEL核实,上面的6月4,5,6三天的价格无误