蜗牛博客VNPY学习记录:

VN.PY 2.0学习记录一(如何回测)

VN.PY 2.0学习记录二(策略开发)

Vn.py学习记录三(米筐教程)

VN.PY 2.0学习记录四(多线程、多进程)

Vn.py学习记录五–交易时间段及Widgets

Vn.py学习记录六(无界面模拟盘)

Vn.py学习记录七(V2.0.5版本)

Vnpy学习记录八(R-Breaker及pickle)

Vn.py学习记录九(事件驱动引擎)

VN.PY学习记录十(源码概述)

VNPY学习记录11(微信+Vscode)

VNPY学习记录12(父子进程、回调函数)

VNPY学习记录13(部署到云服务器,实现自动交易)

一、如何将成交信息发到微信

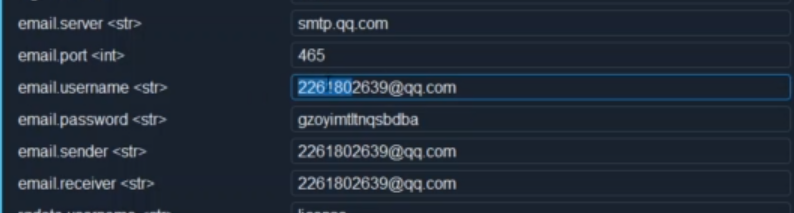

原理:利用vnpy的内置函数发送邮件到qq邮箱,微信绑定QQ邮箱,在微信收到信息。

1、设定邮箱,注意password是邮箱授权码。

2、发送邮件的代码,写在on_trade

def on_trade(self.trade:TradeData):

msg = f" 新的成交,策略{self.strategy_name},方向{trade.direction},开平{trade.offset},当前仓位{self.pos}"

self.send_email(msg)

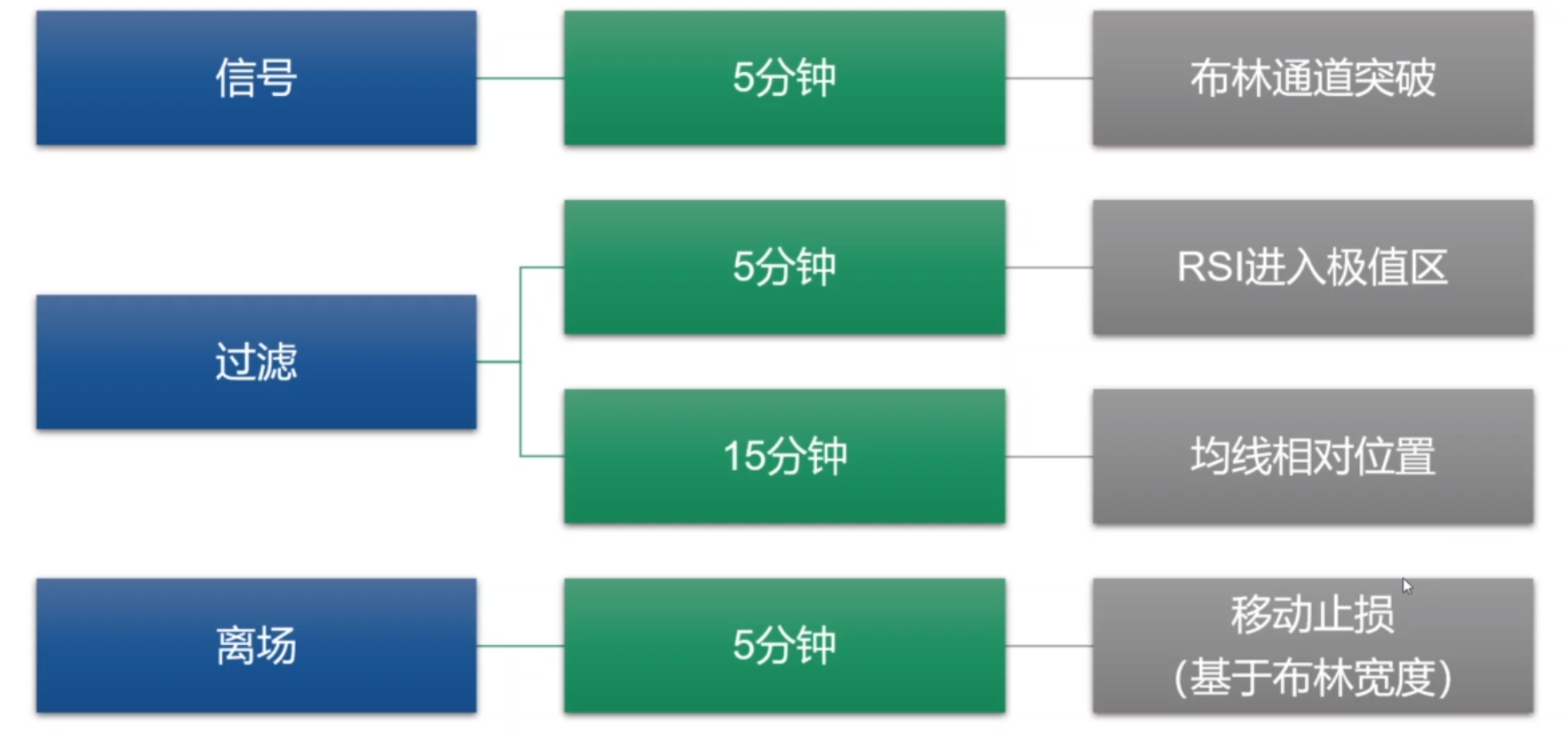

二、curtro策略

复习的知识要点:

1.布林的代码(包括参数、使用)

2.RSI的代码

3.双均线的代码

4.移动上操的代码

from vnpy.app.cta_strategy import (

CtaTemplate,

BarGenerator,

ArrayManager,

TickData,

BarData,

OrderData,

TradeData,

StopOrder

)

class CuatroStrategy(CtaTemplate):

""""""

author = "vn_trader"

boll_window = 20

boll_dev = 1.8

rsi_window = 14

rsi_signal = 19

fast_window = 4

slow_window = 26

trailing_long = 0.5

trailing_short = 0.3

fixed_size = 1

boll_up = 0

boll_down = 0

rsi_value = 0

rsi_long = 0

rsi_short = 0

fast_ma = 0

slow_ma = 0

ma_trend = 0

intra_trade_high = 0

intra_trade_low = 0

long_stop = 0

short_stop = 0

parameters = [

"boll_window",

"boll_dev",

"rsi_window",

"rsi_signal",

"fast_window",

"slow_window",

"trailing_long",

"trailing_short",

"fixed_size"

]

variables = [

"boll_up",

"boll_down",

"rsi_value",

"rsi_long",

"rsi_short",

"fast_ma",

"slow_ma",

"ma_trend",

"intra_trade_high",

"intra_trade_low",

"long_stop",

"short_stop"

]

def __init__(

self,

cta_engine,

strategy_name: str,

vt_symbol: str,

setting: dict,

):

""""""

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.rsi_long = 50 + self.rsi_signal

self.rsi_short = 50 - self.rsi_signal

self.bg5 = BarGenerator(self.on_bar, 5, self.on_5min_bar) #BarGenerator,ArrayManager几乎是标配。

self.bg15 = BarGenerator(self.on_bar, 15, self.on_15min_bar)

self.am5 = ArrayManager()

self.am15 = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(10) #这个不要漏掉,不然有时会报错。

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

self.bg5.update_tick(tick) #将tick推送给bargenerator,合成1分钟bar

def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.bg5.update_bar(bar)

self.bg15.update_bar(bar)

def on_5min_bar(self, bar: BarData):

""""""

self.cancel_all()

self.am5.update_bar(bar)

if not self.am5.inited or not self.am15.inited:

return

self.boll_up, self.boll_down = self.am5.boll(self.boll_window, self.boll_dev)

self.rsi_value = self.am5.rsi(self.rsi_window)

boll_width = self.boll_up - self.boll_down

# No position

if self.pos == 0:

self.intra_trade_high = bar.high_price

self.intra_trade_low = bar.low_price

self.long_stop = 0

self.short_stop = 0

if self.ma_trend > 0 and self.rsi_value >= self.rsi_long:

self.buy(self.boll_up, self.fixed_size, stop=True)

if self.ma_trend < 0 and self.rsi_value <= self.rsi_short:

self.short(self.boll_down, self.fixed_size, stop=True)

# Long position

elif self.pos > 0:

self.intra_trade_high = max(self.intra_trade_high, bar.high_price)

self.long_stop = (self.intra_trade_high - self.trailing_long * boll_width)

self.sell(self.long_stop, abs(self.pos), stop=True)

# Short position

else:

self.intra_trade_low = min(self.intra_trade_low, bar.low_price)

self.short_stop = (self.intra_trade_low + self.trailing_short * boll_width)

self.cover(self.short_stop, abs(self.pos), stop=True)

self.put_event()

def on_15min_bar(self, bar: BarData):

""""""

self.am15.update_bar(bar)

if not self.am15.inited:

return

self.fast_ma = self.am15.sma(self.fast_window)

self.slow_ma = self.am15.sma(self.slow_window)

if self.fast_ma > self.slow_ma:

self.ma_trend = 1

elif self.fast_ma < self.slow_ma:

self.ma_trend = -1

else:

self.ma_trend = 0

self.put_event()

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass

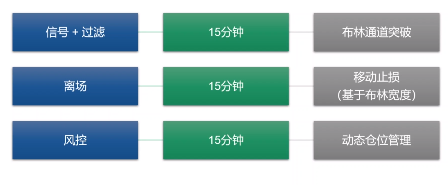

三、cinco策略(动态仓位管理)

代码

from vnpy.app.cta_strategy import (

CtaTemplate,

BarGenerator,

ArrayManager,

TickData,

BarData,

OrderData,

TradeData,

StopOrder

)

class CincoStrategy(CtaTemplate):

""""""

author = "vnpy"

boll_window = 42

boll_dev = 2.2

trailing_long = 0.65

trailing_short = 0.65

atr_window = 4

risk_level = 300

boll_up = 0

boll_down = 0

trading_size = 0

intra_trade_high = 0

intra_trade_low = 0

long_stop = 0

short_stop = 0

atr_value = 0

parameters = [

"boll_window",

"boll_dev",

"trailing_long",

"trailing_short",

"atr_window",

"risk_level"

]

variables = [

"boll_up",

"boll_down",

"trading_size",

"intra_trade_high",

"intra_trade_low",

"long_stop",

"short_stop",

"atr_value"

]

def __init__(

self,

cta_engine,

strategy_name: str,

vt_symbol: str,

setting: dict,

):

""""""

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.bg = BarGenerator(self.on_bar, 15, self.on_15min_bar)

self.am = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(10)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

self.bg.update_tick(tick)

def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.bg.update_bar(bar)

def on_15min_bar(self, bar: BarData):

""""""

self.cancel_all()

self.am.update_bar(bar)

if not self.inited:

return

self.boll_up, self.boll_down = self.am.boll(self.boll_window, self.boll_dev)

boll_width = self.boll_up - self.boll_down

if not self.pos:

self.atr_value = self.am.atr(self.atr_window)

self.trading_size = int(self.risk_level / self.atr_value)

self.intra_trade_high = bar.high_price

self.intra_trade_low = bar.low_price

self.long_stop = 0

self.short_stop = 0

self.buy(self.boll_up, self.trading_size, stop=True)

self.short(self.boll_down, self.trading_size, stop=True)

elif self.pos > 0:

self.intra_trade_high = max(self.intra_trade_high, bar.high_price)

self.long_stop = self.intra_trade_high - self.trailing_long * boll_width

self.sell(self.long_stop, abs(self.pos), stop=True)

else:

self.intra_trade_low = min(self.intra_trade_low, bar.low_price)

self.short_stop = self.intra_trade_low + self.trailing_short * boll_width

self.cover(self.short_stop, abs(self.pos), stop=True)

self.put_event()

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass