蜗牛博客VNPY源码学习系列文章

VNPY源码(一)CTP封装及K线合成

VNPY源码(二)API获取行情和script_trader

VNPY源码(三)主引擎MainEngine

VNPY源码(四)DataRecorder

VNPY源码(五)CtaEngine实盘引擎

VNPY源码(六)BacktesterEngine回测引擎

VNPY源码(七)限价单与停止单

VNPY源码(八)VNPY的数据流

提示:

回测时最好使用脚本,使用UI界面回测经常出错了啥提示也没有,让你抓狂。

首先看看回测引擎的代码:

from vnpy.app.cta_strategy.backtesting import BacktestingEngine

from vnpy.app.cta_strategy.strategies.boll_channel_strategy import BollChannelStrategy

from datetime import datetime

engine = BacktestingEngine()

engine.set_parameters(

vt_symbol = "000001.SZSE",

interval ="d",

start = datetime(2018,3,23),

end = datetime(2018,4,23),

rate = 0,

slippage = 0,

size = 300,

pricetick = 0.2,

capital = 1_000_000,

)

engine.add_strategy(BollChannelStrategy,{})

engine.load_data()

engine.run_backtesting()

df = engine.calculate_result()

engine.calculate_statistics()

engine.show_chart()

一、首先看一下set_parameters函数。

首先要明确,这是BacktestingEngine,是在vnpy/app/cta_strategy/backtesting.py这里面定义的,在vnpy/app/cta_backtester/engine.py里面,有一个BacktesterEngine,很容易搞混。

这个函数没啥特别的地方,就是赋值。

二、add_strategy

传入参数,实例化一个策略,相当于执行了DoubleMaStrategy(strategy_name,vt_symbol, setting)

def add_strategy(self, strategy_class: type, setting: dict):

""""""

self.strategy_class = strategy_class

self.strategy = strategy_class(

self, strategy_class.__name__, self.vt_symbol, setting

)

三、loda_data

最终的结果是通过数据库的ORM取出DbBarData,遍历DbBarData,通过to_tick或to_bar方法生成tick或Bar,最终得到self.history_data(里面保存tick或bar)。

def load_data(self):

""""""

self.output("开始加载历史数据")

if not self.end:

self.end = datetime.now()

if self.start >= self.end:

self.output("起始日期必须小于结束日期")

return

self.history_data.clear() # Clear previously loaded history data

# Load 30 days of data each time and allow for progress update

progress_delta = timedelta(days=30)

total_delta = self.end - self.start

start = self.start

end = self.start + progress_delta

progress = 0

while start < self.end:

end = min(end, self.end) # Make sure end time stays within set range

if self.mode == BacktestingMode.BAR:

data = load_bar_data(

self.symbol,

self.exchange,

self.interval,

start,

end

)

else:

data = load_tick_data(

self.symbol,

self.exchange,

start,

end

)

self.history_data.extend(data)

progress += progress_delta / total_delta

progress = min(progress, 1)

progress_bar = "#" * int(progress * 10)

self.output(f"加载进度:{progress_bar} [{progress:.0%}]")

start = end

end += progress_delta

self.output(f"历史数据加载完成,数据量:{len(self.history_data)}")

1.load_bar_data

@lru_cache(maxsize=999)

def load_bar_data(

symbol: str,

exchange: Exchange,

interval: Interval,

start: datetime,

end: datetime

):

""""""

return database_manager.load_bar_data(

symbol, exchange, interval, start, end

)

它其实是调用database_manager的load_bar_data方法。通过查看头部可以发现from vnpy.trader.database import database_manager,可是在vnpy.trader.database下面没有找到这个database_manager,只在init.py找到下面这句:database_manager: "BaseDatabaseManager" = init(settings=settings),据官方的说法:

这里的database_manager,是在database内部代码中定义的,并会基于GlobalSetting中的数据库配置自行创建配置不同的对象,inti函数就是返回这个对象

然后在vnpy\trader\database\database_mongo.py里面找到下在的语句。

class MongoManager(BaseDatabaseManager):

def load_bar_data(

self,

symbol: str,

exchange: Exchange,

interval: Interval,

start: datetime,

end: datetime,

) -> Sequence[BarData]:

s = DbBarData.objects(

symbol=symbol,

exchange=exchange.value,

interval=interval.value,

datetime__gte=start,

datetime__lte=end,

)

data = [db_bar.to_bar() for db_bar in s]

return data

这里的.objects是MangoDB的ORM语法。

2.to.bar函数:

def to_bar(self):

"""

Generate BarData object from DbBarData.

"""

bar = BarData(

symbol=self.symbol,

exchange=Exchange(self.exchange),

datetime=self.datetime,

interval=Interval(self.interval),

volume=self.volume,

open_interest=self.open_interest,

open_price=self.open_price,

high_price=self.high_price,

low_price=self.low_price,

close_price=self.close_price,

gateway_name="DB",

)

return bar

再看看to_tick函数

def to_tick(self):

"""

Generate TickData object from DbTickData.

"""

tick = TickData(

symbol=self.symbol,

exchange=Exchange(self.exchange),

datetime=self.datetime,

name=self.name,

volume=self.volume,

open_interest=self.open_interest,

last_price=self.last_price,

last_volume=self.last_volume,

limit_up=self.limit_up,

limit_down=self.limit_down,

open_price=self.open_price,

high_price=self.high_price,

low_price=self.low_price,

pre_close=self.pre_close,

bid_price_1=self.bid_price_1,

ask_price_1=self.ask_price_1,

bid_volume_1=self.bid_volume_1,

ask_volume_1=self.ask_volume_1,

gateway_name="DB",

)

if self.bid_price_2:

tick.bid_price_2 = self.bid_price_2

tick.bid_price_3 = self.bid_price_3

tick.bid_price_4 = self.bid_price_4

tick.bid_price_5 = self.bid_price_5

tick.ask_price_2 = self.ask_price_2

tick.ask_price_3 = self.ask_price_3

tick.ask_price_4 = self.ask_price_4

tick.ask_price_5 = self.ask_price_5

tick.bid_volume_2 = self.bid_volume_2

tick.bid_volume_3 = self.bid_volume_3

tick.bid_volume_4 = self.bid_volume_4

tick.bid_volume_5 = self.bid_volume_5

tick.ask_volume_2 = self.ask_volume_2

tick.ask_volume_3 = self.ask_volume_3

tick.ask_volume_4 = self.ask_volume_4

tick.ask_volume_5 = self.ask_volume_5

return tick

四、run_backtesting

这个函数的作是初始化策略,遍历之前的history_data,并撮合限价单,撮合停止单,再执行策略的on_bar函数。

def run_backtesting(self):

""""""

if self.mode == BacktestingMode.BAR:

func = self.new_bar

else:

func = self.new_tick

self.strategy.on_init()

# Use the first [days] of history data for initializing strategy

day_count = 0

ix = 0

for ix, data in enumerate(self.history_data):

if self.datetime and data.datetime.day != self.datetime.day:

day_count += 1

if day_count >= self.days:

break

self.datetime = data.datetime

self.callback(data)

self.strategy.inited = True

self.output("策略初始化完成")

self.strategy.on_start()

self.strategy.trading = True

self.output("开始回放历史数据")

# Use the rest of history data for running backtesting

for data in self.history_data[ix:]:

func(data)

self.output("历史数据回放结束")

1.history_data

这里的history_data是在执行engine.load_data()后得到的。前面有定义ix=0,所以history_data[ix:]就是所有的数据了。

2.new_bar函数

先撮合限价单,再撮合停止单,再执行策略的on_bar函数,进行策略的判断,最后更新每天的收盘价?

def new_bar(self, bar: BarData):

""""""

self.bar = bar

self.datetime = bar.datetime

#选对之前的订单进行撮合。

self.cross_limit_order()

self.cross_stop_order()

self.strategy.on_bar(bar)

self.update_daily_close(bar.close_price)

3.撮合成交

def cross_limit_order(self):

"""

Cross limit order with last bar/tick data.这是限价单,即低于多少价买入

"""

if self.mode == BacktestingMode.BAR:

##买入的条件是价格低于多少买入,撮合价当然按最低价来算。

long_cross_price = self.bar.low_price

short_cross_price = self.bar.high_price

##有一种情况,比如设定价格低于98元就买入,下一根k线一开盘就成了95元,然后一路下跌,这时的成交价就是开盘价,不是最低价了。

long_best_price = self.bar.open_price

short_best_price = self.bar.open_price

else:

long_cross_price = self.tick.ask_price_1

short_cross_price = self.tick.bid_price_1

long_best_price = long_cross_price

short_best_price = short_cross_price

for order in list(self.active_limit_orders.values()):

# Push order update with status "not traded" (pending).

##这里出现了order,self.active_limit_orders = {}是一个字典,是类开头定义的

if order.status == Status.SUBMITTING:

order.status = Status.NOTTRADED

self.strategy.on_order(order)

# Check whether limit orders can be filled.

#限价单情况下,多单成交的条件判断:1.指令是多单;2.回测K线的最低价(long_cross_price)小于发出指令的价格;3.回测K线的最低价(long_cross_price)大于0.

long_cross = (

order.direction == Direction.LONG

and order.price >= long_cross_price

and long_cross_price > 0

)

short_cross = (

order.direction == Direction.SHORT

and order.price <= short_cross_price

and short_cross_price > 0

)

if not long_cross and not short_cross:

continue

# Push order udpate with status "all traded" (filled).

order.traded = order.volume

order.status = Status.ALLTRADED

self.strategy.on_order(order)

self.active_limit_orders.pop(order.vt_orderid)

# Push trade update

#生成订单信息

self.trade_count += 1

if long_cross:

#订单的成交价格

trade_price = min(order.price, long_best_price)

pos_change = order.volume

else:

trade_price = max(order.price, short_best_price)

pos_change = -order.volume

trade = TradeData(

symbol=order.symbol,

exchange=order.exchange,

orderid=order.orderid,

tradeid=str(self.trade_count),

direction=order.direction,

offset=order.offset,

price=trade_price,

volume=order.volume,

time=self.datetime.strftime("%H:%M:%S"),

gateway_name=self.gateway_name,

)

trade.datetime = self.datetime

self.strategy.pos += pos_change

self.strategy.on_trade(trade)

self.trades[trade.vt_tradeid] = trade

五、buy、sell

策略中的on_bar函数中有buy, sell函数。通过查看CtaTemplate可知,buy\sell\short\cover四个函数都是调用send_order。

def buy(self, price: float, volume: float, stop: bool = False):

"""

Send buy order to open a long position.

"""

return self.send_order(Direction.LONG, Offset.OPEN, price, volume, stop)

那我们就来看看send_order

def send_order(

self,

direction: Direction,

offset: Offset,

price: float,

volume: float,

stop: bool = False,

lock: bool = False

):

"""

Send a new order.

"""

if self.trading:

vt_orderids = self.cta_engine.send_order(

self, direction, offset, price, volume, stop, lock

)

return vt_orderids

else:

return []

看后查看发现self.cta_engine = cta_engine,再看它的源码

def send_order(

self,

strategy: CtaTemplate,

direction: Direction,

offset: Offset,

price: float,

volume: float,

stop: bool,

lock: bool

):

"""

"""

contract = self.main_engine.get_contract(strategy.vt_symbol)

if not contract:

self.write_log(f"委托失败,找不到合约:{strategy.vt_symbol}", strategy)

return ""

if stop:

if contract.stop_supported:

return self.send_server_stop_order(strategy, contract, direction, offset, price, volume, lock)

else:

return self.send_local_stop_order(strategy, direction, offset, price, volume, lock)

else:

return self.send_limit_order(strategy, contract, direction, offset, price, volume, lock)

再看send_limit_order、send_server_stop_order,发现它是调用send_server_order函数。

def send_server_order(

self,

strategy: CtaTemplate,

contract: ContractData,

direction: Direction,

offset: Offset,

price: float,

volume: float,

type: OrderType,

lock: bool

):

"""

Send a new order to server.

"""

# Create request and send order.

original_req = OrderRequest(

symbol=contract.symbol,

exchange=contract.exchange,

direction=direction,

offset=offset,

type=type,

price=price,

volume=volume,

)

# Convert with offset converter

req_list = self.offset_converter.convert_order_request(original_req, lock)

# Send Orders

vt_orderids = []

for req in req_list:

vt_orderid = self.main_engine.send_order(

req, contract.gateway_name)

vt_orderids.append(vt_orderid)

self.offset_converter.update_order_request(req, vt_orderid)

# Save relationship between orderid and strategy.

self.orderid_strategy_map[vt_orderid] = strategy

self.strategy_orderid_map[strategy.strategy_name].add(vt_orderid)

return vt_orderids

main.engine中的send_order。

def send_order(self, req: OrderRequest, gateway_name: str):

"""

Send new order request to a specific gateway.

"""

gateway = self.get_gateway(gateway_name)

if gateway:

return gateway.send_order(req)

else:

return ""

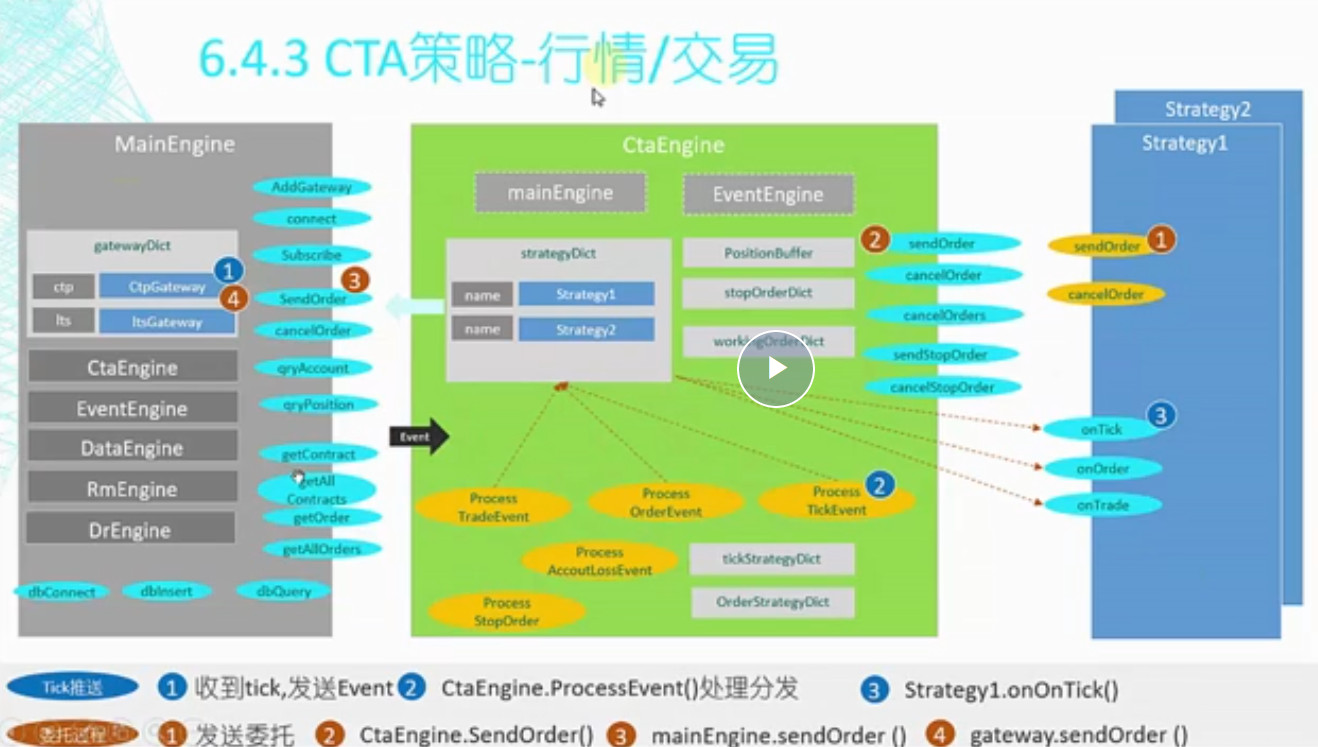

即下面这张图的流程:

那么回测的时候也是执行策略中的on_bar函数,那么sell,buy在哪里区分出来是回测还是实盘的?应该BacktestingEngine里面这个self就代表回测引擎。

def add_strategy(self, strategy_class: type, setting: dict):

""""""

self.strategy_class = strategy_class

self.strategy = strategy_class(

self, strategy_class.__name__, self.vt_symbol, setting

)

最后看一个函数send_local_stop_order。

def send_local_stop_order(

self,

strategy: CtaTemplate,

direction: Direction,

offset: Offset,

price: float,

volume: float,

lock: bool

):

"""

Create a new local stop order.

"""

self.stop_order_count += 1

stop_orderid = f"{STOPORDER_PREFIX}.{self.stop_order_count}"

stop_order = StopOrder(

vt_symbol=strategy.vt_symbol,

direction=direction,

offset=offset,

price=price,

volume=volume,

stop_orderid=stop_orderid,

strategy_name=strategy.strategy_name,

lock=lock

)

self.stop_orders[stop_orderid] = stop_order

vt_orderids = self.strategy_orderid_map[strategy.strategy_name]

vt_orderids.add(stop_orderid)

self.call_strategy_func(strategy, strategy.on_stop_order, stop_order)

self.put_stop_order_event(stop_order)

return stop_orderid

六 、calculate_result

这个函数的功能是实现逐日盯市盈亏计算,返回一个名叫daily_df的DataFrame。

def calculate_result(self):

""""""

self.output("开始计算逐日盯市盈亏")

if not self.trades:

self.output("成交记录为空,无法计算")

return

# Add trade data into daily reuslt.

for trade in self.trades.values():

d = trade.datetime.date()

daily_result = self.daily_results[d]

daily_result.add_trade(trade)

# Calculate daily result by iteration.

pre_close = 0

start_pos = 0

for daily_result in self.daily_results.values():

daily_result.calculate_pnl(

pre_close, start_pos, self.size, self.rate, self.slippage

)

pre_close = daily_result.close_price

start_pos = daily_result.end_pos

# Generate dataframe

results = defaultdict(list)

for daily_result in self.daily_results.values():

for key, value in daily_result.__dict__.items():

results[key].append(value)

self.daily_df = DataFrame.from_dict(results).set_index("date")

self.output("逐日盯市盈亏计算完成")

return self.daily_df

1.self.trades

这里出现了self.trades,它是一个字典,我们发现它是在cross_limit_order、cross_stop_order这两个函数里面有赋值。因为这两个函数比较复杂难懂,关于这两个函数,打算下一章专门探索。

2.add_trade

这里出现了一个add_trade函数,非常简单,差不多就是一个append的封装。

def add_trade(self, trade: TradeData):

""""""

self.trades.append(trade)

3.calculate_pnl

def calculate_pnl(

self,

pre_close: float,

start_pos: float,

size: int,

rate: float,

slippage: float,

):

""""""

self.pre_close = pre_close

# Holding pnl is the pnl from holding position at day start

self.start_pos = start_pos

self.end_pos = start_pos

self.holding_pnl = self.start_pos * \

(self.close_price - self.pre_close) * size

# Trading pnl is the pnl from new trade during the day

self.trade_count = len(self.trades)

for trade in self.trades:

if trade.direction == Direction.LONG:

pos_change = trade.volume

else:

pos_change = -trade.volume

turnover = trade.price * trade.volume * size

self.trading_pnl += pos_change * \

(self.close_price - trade.price) * size

self.end_pos += pos_change

self.turnover += turnover

self.commission += turnover * rate

self.slippage += trade.volume * size * slippage

# Net pnl takes account of commission and slippage cost

self.total_pnl = self.trading_pnl + self.holding_pnl

self.net_pnl = self.total_pnl - self.commission - self.slippage

七、calculate_statistics

这个函数的功能是计算策略统计指标,返回一个统计指标的字典:

def calculate_statistics(self, df: DataFrame = None, output=True):

""""""

self.output("开始计算策略统计指标")

# Check DataFrame input exterior

if df is None:

df = self.daily_df

# Check for init DataFrame

if df is None:

# Set all statistics to 0 if no trade.

start_date = ""

end_date = ""

total_days = 0

......

return_drawdown_ratio = 0

else:

# Calculate balance related time series data

df["balance"] = df["net_pnl"].cumsum() + self.capital

df["return"] = np.log(df["balance"] / df["balance"].shift(1)).fillna(0)

df["highlevel"] = (

df["balance"].rolling(

min_periods=1, window=len(df), center=False).max()

)

df["drawdown"] = df["balance"] - df["highlevel"]

df["ddpercent"] = df["drawdown"] / df["highlevel"] * 100

# Calculate statistics value

start_date = df.index[0]

end_date = df.index[-1]

total_days = len(df)

profit_days = len(df[df["net_pnl"] > 0])

loss_days = len(df[df["net_pnl"] < 0])

end_balance = df["balance"].iloc[-1]

max_drawdown = df["drawdown"].min()

max_ddpercent = df["ddpercent"].min()

total_net_pnl = df["net_pnl"].sum()

daily_net_pnl = total_net_pnl / total_days

total_commission = df["commission"].sum()

daily_commission = total_commission / total_days

total_slippage = df["slippage"].sum()

daily_slippage = total_slippage / total_days

total_turnover = df["turnover"].sum()

daily_turnover = total_turnover / total_days

total_trade_count = df["trade_count"].sum()

daily_trade_count = total_trade_count / total_days

total_return = (end_balance / self.capital - 1) * 100

annual_return = total_return / total_days * 240

daily_return = df["return"].mean() * 100

return_std = df["return"].std() * 100

if return_std:

sharpe_ratio = daily_return / return_std * np.sqrt(240)

else:

sharpe_ratio = 0

return_drawdown_ratio = -total_return / max_ddpercent

# Output

if output:

self.output("-" * 30)

self.output(f"首个交易日:\t{start_date}")

self.output(f"最后交易日:\t{end_date}")

self.output(f"总交易日:\t{total_days}")

self.output(f"盈利交易日:\t{profit_days}")

self.output(f"亏损交易日:\t{loss_days}")

self.output(f"起始资金:\t{self.capital:,.2f}")

self.output(f"结束资金:\t{end_balance:,.2f}")

self.output(f"总收益率:\t{total_return:,.2f}%")

self.output(f"年化收益:\t{annual_return:,.2f}%")

self.output(f"最大回撤: \t{max_drawdown:,.2f}")

self.output(f"百分比最大回撤: {max_ddpercent:,.2f}%")

self.output(f"总盈亏:\t{total_net_pnl:,.2f}")

self.output(f"总手续费:\t{total_commission:,.2f}")

self.output(f"总滑点:\t{total_slippage:,.2f}")

self.output(f"总成交金额:\t{total_turnover:,.2f}")

self.output(f"总成交笔数:\t{total_trade_count}")

self.output(f"日均盈亏:\t{daily_net_pnl:,.2f}")

self.output(f"日均手续费:\t{daily_commission:,.2f}")

self.output(f"日均滑点:\t{daily_slippage:,.2f}")

self.output(f"日均成交金额:\t{daily_turnover:,.2f}")

self.output(f"日均成交笔数:\t{daily_trade_count}")

self.output(f"日均收益率:\t{daily_return:,.2f}%")

self.output(f"收益标准差:\t{return_std:,.2f}%")

self.output(f"Sharpe Ratio:\t{sharpe_ratio:,.2f}")

self.output(f"收益回撤比:\t{return_drawdown_ratio:,.2f}")

statistics = {

"start_date": start_date,

"end_date": end_date,

"total_days": total_days,

"profit_days": profit_days,

"loss_days": loss_days,

"capital": self.capital,

"end_balance": end_balance,

"max_drawdown": max_drawdown,

"max_ddpercent": max_ddpercent,

"total_net_pnl": total_net_pnl,

"daily_net_pnl": daily_net_pnl,

"total_commission": total_commission,

"daily_commission": daily_commission,

"total_slippage": total_slippage,

"daily_slippage": daily_slippage,

"total_turnover": total_turnover,

"daily_turnover": daily_turnover,

"total_trade_count": total_trade_count,

"daily_trade_count": daily_trade_count,

"total_return": total_return,

"annual_return": annual_return,

"daily_return": daily_return,

"return_std": return_std,

"sharpe_ratio": sharpe_ratio,

"return_drawdown_ratio": return_drawdown_ratio,

}

return statistics

八、show_chart

最后是显示图表的函数。

def show_chart(self, df: DataFrame = None):

""""""

# Check DataFrame input exterior

if df is None:

df = self.daily_df

# Check for init DataFrame

if df is None:

return

plt.figure(figsize=(10, 16))

balance_plot = plt.subplot(4, 1, 1) #表示4行*1列,第一个图

balance_plot.set_title("Balance")

df["balance"].plot(legend=True)

drawdown_plot = plt.subplot(4, 1, 2)

drawdown_plot.set_title("Drawdown")

drawdown_plot.fill_between(range(len(df)), df["drawdown"].values)

pnl_plot = plt.subplot(4, 1, 3)

pnl_plot.set_title("Daily Pnl")

df["net_pnl"].plot(kind="bar", legend=False, grid=False, xticks=[])

distribution_plot = plt.subplot(4, 1, 4)

distribution_plot.set_title("Daily Pnl Distribution")

df["net_pnl"].hist(bins=50)

plt.show()