一、简单介绍

二、知识点

1.np.sign

2.iloc[:,:-1]

提取所有行,而后提取除最后一列之外的所有列。

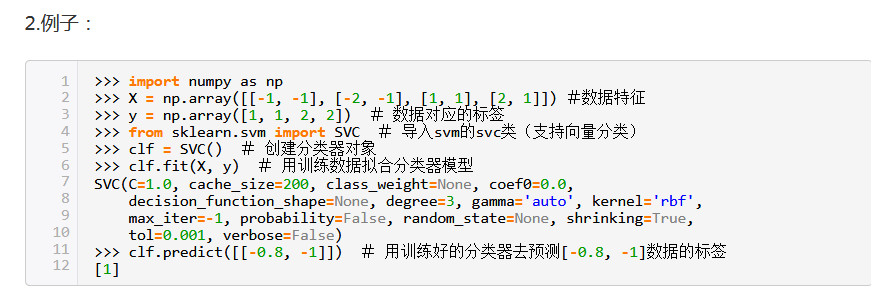

3.clf.fit(x,y)

比如下面代码中的train_df.iloc[:,-1:]就是label那一列。

4. sklearn 保存模型

经实测可用

from sklearn import svm

from sklearn import datasets

clf = svm.SVC()

iris = datasets.load_iris()

X, y = iris.data, iris.target

clf.fit(X,y)

import pickle #pickle模块

#保存Model(注:save文件夹要预先建立,否则会报错)

with open('clf.pickle', 'wb') as f:

pickle.dump(clf, f)

#读取Model

with open('clf.pickle', 'rb') as f:

clf2 = pickle.load(f)

#测试读取后的Model

print(clf2.predict(X[0:1]))

参考:https://www.cnblogs.com/Allen-rg/p/9548539.html

实际调用:

# 随机深林训练 导入包

from sklearn.ensemble import RandomForestClassifier

from sklearn.metrics import f1_score, precision_score, confusion_matrix, recall_score, accuracy_score

# 训练模型

clf = RandomForestClassifier(n_estimators=65, max_features="auto",max_depth=30,min_samples_split=200)

with open('clf02.pickle', 'rb') as f:

clf = pickle.load(f)

#测试读取后的Model

# 模型调用

pre_train = clf.predict(train_df.iloc[:,:-1])

# print("在训练集预测的结果为:",pre_train)

print("在训练集的accuracy_score为:",accuracy_score(pre_train,train_df.iloc[:,-1:]))

2.KDJ指标

def stochastic_oscillator_d(df, n):

#这个指标返回的是ohlc,volume,SOK值的df

SOK = [0]

for i in range(n, len(df)):

high = df.loc[(i-n):i, 'high']

# 截取最高价中的一段

low = df.loc[(i-n):i, 'low']

SOK.append((df.loc[i, 'close'] - min(low)) / (max(high) - min(low)))

# 计算出K值

SOK = pd.Series(SOK, name='SOK')

df = df.join(SOK)

return df

3.威廉指数

这个和上面的差不多,只不过分母变成了n日最高价-最新的收盘价。

计算出的指数值在0至100之间波动,不同的是,威廉指数的值越小,市场的买气越重,反之,其值越大,市场卖气越浓。

当%R线达到80时,市场处于超卖状况,股价走势随时可能见底。因此,80的横线一般称为买进线,投资者在此可以伺机买入;相反,当%R线达到20时,市场处于超买状况,走势可能即将见顶,20的横线被称为卖出线。

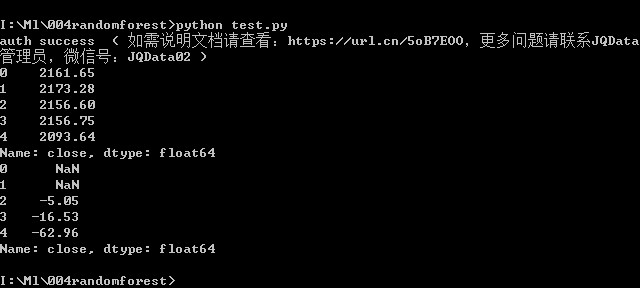

4.diff

M = df['close'].diff(3-1)

就表示用第3个close减去第1个close,用第4个减去第2个。

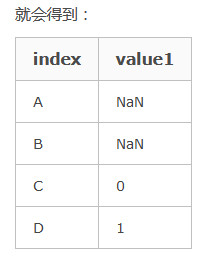

5.df.shift(2)

表示向后移2

6.accuracy_score

sklearn.metrics.accuracy_score(y_true, y_pred, normalize=True, sample_weight=None)

normalize:默认值为True,返回正确分类的比例;如果为False,返回正确分类的样本数。

>>>import numpy as np >>>from sklearn.metrics import accuracy_score >>>y_pred = [0, 2, 1, 3] >>>y_true = [0, 1, 2, 3] >>>accuracy_score(y_true, y_pred) 0.5 >>>accuracy_score(y_true, y_pred, normalize=False) 2

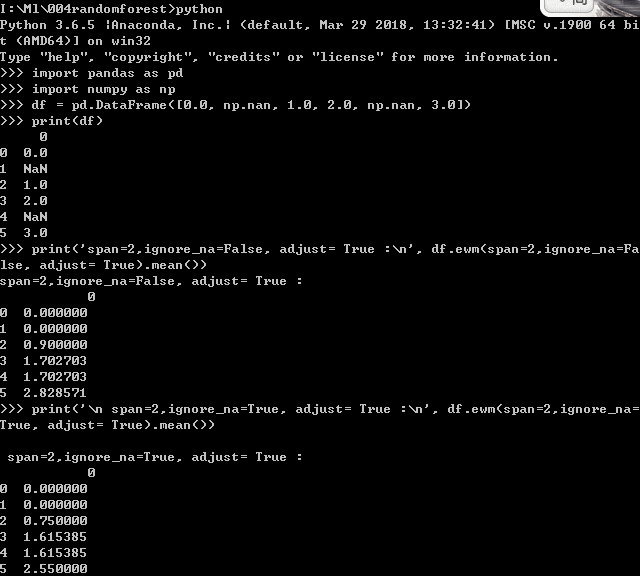

7.pandas ewm

可以参考:https://pandas.pydata.org/pandas-docs/stable/reference/api/pandas.DataFrame.ewm.html

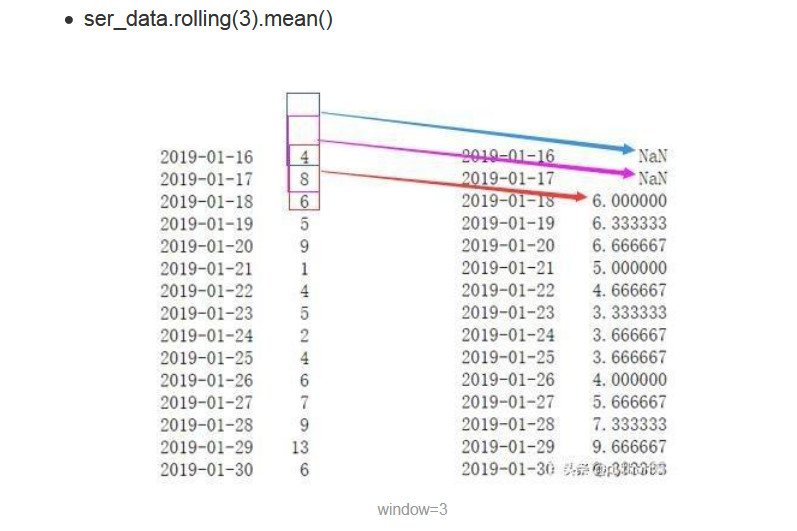

8.pandas.rolling

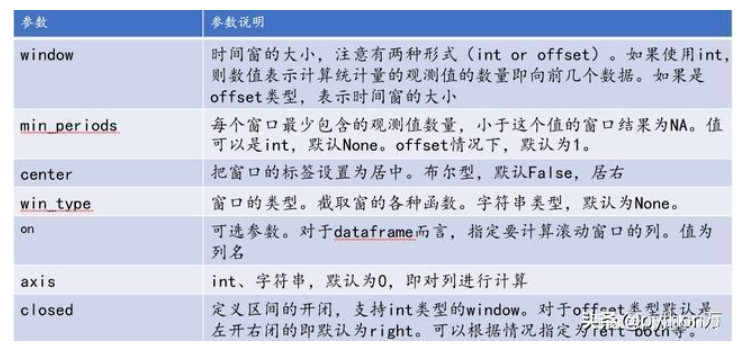

pandas中提供了pandas.DataFrame.rolling这个函数来实现滑动窗口值计算,下面是这个函数的原型:

DataFrame.rolling(window, min_periods=None, center=False, win_type=None, on=None, axis=0, closed=None),参数含义如下图:

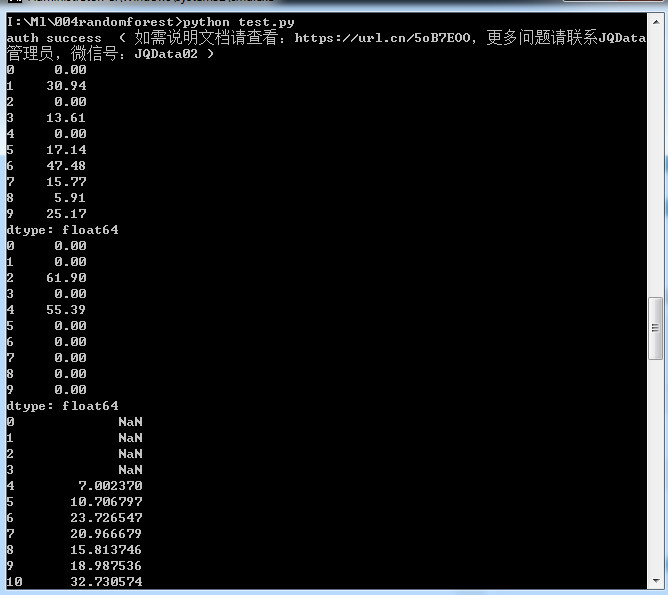

8.RSI

N日RSI =N日内收盘涨幅的平均值/(N日内收盘涨幅均值+N日内收盘跌幅均值) ×100

def relative_strength_index(df, n):

i = 0

UpI = [0]

DoI = [0]

while i + 1 <= df.index[-1]:

UpMove = df.loc[i + 1, 'high'] - df.loc[i, 'high']

DoMove = df.loc[i, 'low'] - df.loc[i + 1, 'low']

if UpMove > DoMove and UpMove > 0:

UpD = UpMove

else:

UpD = 0

UpI.append(UpD)

if DoMove > UpMove and DoMove > 0:

DoD = DoMove

else:

DoD = 0

DoI.append(DoD)

i = i + 1

UpI = pd.Series(UpI)

DoI = pd.Series(DoI)

print(UpI.head(10))

print(DoI.head(10))

PosDI = pd.Series(UpI.ewm(span=n, min_periods=n).mean())

NegDI = pd.Series(DoI.ewm(span=n, min_periods=n).mean())

print(PosDI)

RSI = pd.Series(PosDI / (PosDI + NegDI), name='RSI_' + str(n))

df = df.join(RSI)

return df

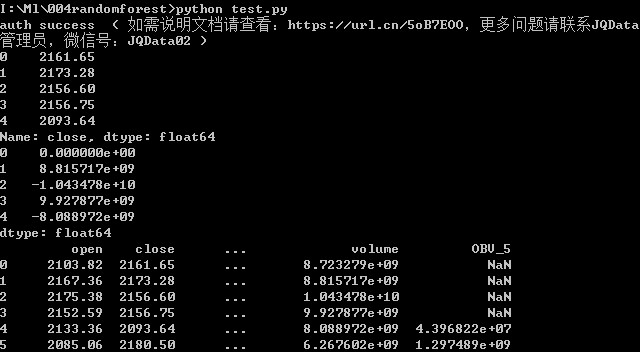

10. OBV

以某日为基期,逐日累计每日上市股票总成交量,若隔日指数或股票上涨,则基期OBV加上本日成交量为本日OBV。隔日指数或股票下跌,则基期OBV减去本日成交量为本日OBV。一般来说,只是观察OBV的升降并无多大意义,必须配合K线图的走势才有实际的效用。

代码

def on_balance_volume(df, n):

i = 0

OBV = [0]

while i < df.index[-1]:

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] > 0:

OBV.append(df.loc[i + 1, 'volume'])

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] == 0:

OBV.append(0)

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] < 0:

OBV.append(-df.loc[i + 1, 'volume'])

i = i + 1

OBV = pd.Series(OBV)

print(OBV.head())

OBV_ma = pd.Series(OBV.rolling(n, min_periods=n).mean(), name='OBV_' + str(n))

df = df.join(OBV_ma)

return df

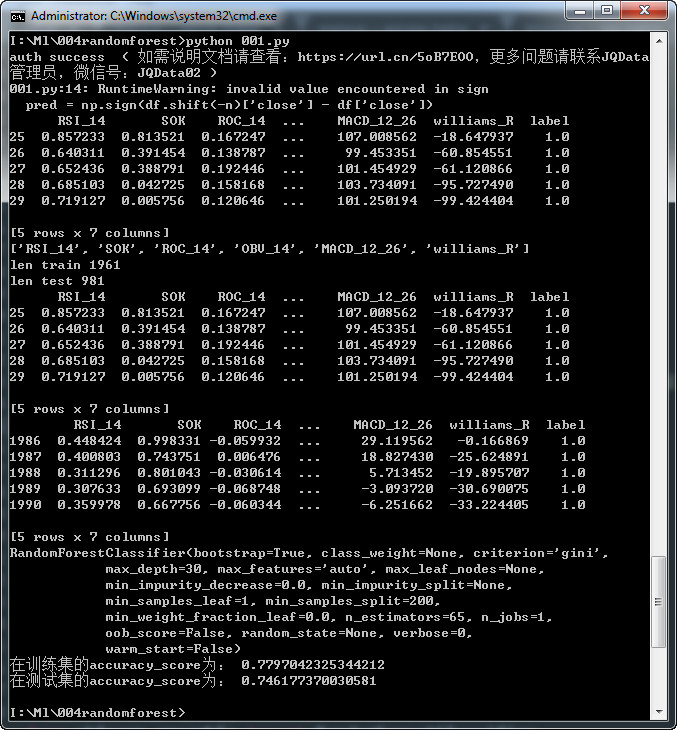

11.clf

print(clf)打印的内容如下:

RandomForestClassifier(bootstrap=True, class_weight=None, criterion='gini',

max_depth=30, max_features='auto', max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=200,

min_weight_fraction_leaf=0.0, n_estimators=65, n_jobs=1,

oob_score=False, random_state=None, verbose=0,

warm_start=False)

二、成果展示

三、代码

# 导入模块

import numpy as np

import pandas as pd

from jqdatasdk import *

auth('138xxxxxxxx','asdf1234')

data = get_price("000001.XSHG",count=3000,end_date="2019-04-03",fields=["open","close","high","low","volume"])

# print(data.head(5))

datas = data.reset_index(drop=True)

datas.head(5)

# # 获取预测的标签 这里n为10 也就是预测10天后的涨跌标签

#这个函数的作用就是将10天后的价格前移10天,与当前价格比较,得到一个数值,根据这个数值的正、负,生成1、-1的结果。

def compute_prediction_int(df, n):

pred = np.sign(df.shift(-n)['close'] - df['close'])

pred = pred.iloc[:-n]

return pred.astype(int)

## 计算Stochastic Oscillator

def stochastic_oscillator_d(df, n):

SOK = [0]

for i in range(n, len(df)):

high = df.loc[(i-n):i, 'high']

low = df.loc[(i-n):i, 'low']

SOK.append((df.loc[i, 'close'] - min(low)) / (max(high) - min(low)))

SOK = pd.Series(SOK, name='SOK')

df = df.join(SOK)

return df

## 计算Williams %R

def williams_R(df, n):

R = [0]

for i in range(n, len(df)):

high = df.loc[(i-n):i, 'high']

low = df.loc[(i-n):i, 'low']

R.append((max(high) - df.loc[i, 'close']) / (max(high) - min(low))*(-100))

williams_R = pd.Series(R, name='williams_R')

df = df.join(williams_R)

return df

## 计算变化率

def rate_of_change(df, n):

M = df['close'].diff(n - 1)

N = df['close'].shift(n - 1)

ROC = pd.Series(M / N, name='ROC_' + str(n))

df = df.join(ROC)

return df

## 计算RSI

def relative_strength_index(df, n):

i = 0

UpI = [0]

DoI = [0]

while i + 1 <= df.index[-1]:

UpMove = df.loc[i + 1, 'high'] - df.loc[i, 'high']

DoMove = df.loc[i, 'low'] - df.loc[i + 1, 'low']

if UpMove > DoMove and UpMove > 0:

UpD = UpMove

else:

UpD = 0

UpI.append(UpD)

if DoMove > UpMove and DoMove > 0:

DoD = DoMove

else:

DoD = 0

DoI.append(DoD)

i = i + 1

UpI = pd.Series(UpI)

DoI = pd.Series(DoI)

PosDI = pd.Series(UpI.ewm(span=n, min_periods=n).mean())

NegDI = pd.Series(DoI.ewm(span=n, min_periods=n).mean())

RSI = pd.Series(PosDI / (PosDI + NegDI), name='RSI_' + str(n))

df = df.join(RSI)

return df

## 计算On Balance Volume

def on_balance_volume(df, n):

i = 0

OBV = [0]

while i < df.index[-1]:

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] > 0:

OBV.append(df.loc[i + 1, 'volume'])

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] == 0:

OBV.append(0)

if df.loc[i + 1, 'close'] - df.loc[i, 'close'] < 0:

OBV.append(-df.loc[i + 1, 'volume'])

i = i + 1

OBV = pd.Series(OBV)

OBV_ma = pd.Series(OBV.rolling(n, min_periods=n).mean(), name='OBV_' + str(n))

df = df.join(OBV_ma)

return df

## 计算MACD

def macd(df, n_fast, n_slow):

EMAfast = pd.Series(df['close'].ewm(span=n_fast, min_periods=n_slow).mean())

EMAslow = pd.Series(df['close'].ewm(span=n_slow, min_periods=n_slow).mean())

MACD = pd.Series(EMAfast - EMAslow, name='MACD_' + str(n_fast) + '_' + str(n_slow))

df = df.join(MACD)

return df

# 数据集准备,返回的是close+各项指标的df。

def feature_extraction(data):

data = relative_strength_index(data, n=14)

data = stochastic_oscillator_d(data, n=14)

data = rate_of_change(data, n=14)

data = on_balance_volume(data, n=14)

data = macd(data, 12, 26)

data = williams_R(data, n = 14)

del(data['open'])

del(data['high'])

del(data['low'])

del(data['volume'])

return data

def prepare_data(df, horizon):

data = feature_extraction(df).dropna().iloc[:-horizon]

data['label'] = compute_prediction_int(data, n=horizon)

del(data['close'])

return data.dropna()

# 数据和特征获取并合并

datas1 = prepare_data(datas, horizon=10)

#将除['gain', 'label']之外的columns提取出来

features = [x for x in datas1.columns if x not in ['gain', 'label']]

print(datas1.head(5))

print(features)

# 训练集和测试集 划分

train_size = 2*len(datas1) // 3 #2/3为训练集。

train_df = datas1[:train_size]

test_df = datas1[train_size:]

print('len train', len(train_df))

print('len test', len(test_df))

print(train_df.head(5))

print(test_df.head(5))

# 随机深林训练 导入包

from sklearn.ensemble import RandomForestClassifier

# 训练模型

clf = RandomForestClassifier(n_estimators=65, max_features="auto",max_depth=30,min_samples_split=200)

print(clf)

from sklearn.ensemble import RandomForestClassifier

from sklearn.metrics import f1_score, precision_score, confusion_matrix, recall_score, accuracy_score

clf.fit(train_df.iloc[:,:-1],train_df.iloc[:,-1:].values.ravel())

# 模型调用

pre_train = clf.predict(train_df.iloc[:,:-1])

# print("在训练集预测的结果为:",pre_train)

print("在训练集的accuracy_score为:",accuracy_score(pre_train,train_df.iloc[:,-1:]))

pre_test = clf.predict(test_df.iloc[:,:-1])

# print("在测试集预测的结果为:",pre_test)

print("在测试集的accuracy_score为:",accuracy_score(pre_test,test_df.iloc[:,-1:]))

参考:https://www.joinquant.com/default/research/index?target=self&url=/default/research/redirect?next=/user/60085672476/clone_url?filename=/%E9%9A%8F%E6%9C%BA%E6%B7%B1%E6%9E%97%E9%A2%84%E6%B5%8B%E8%82%A1%E4%BB%B7.ipynb&url=https://file.joinquant.com/research/users/21781716153/share2/547b5c1052f981aee18d34cfc69e5eeb.htm

这个预测结果确实是很高,但是指标SOK和William R调用了未来数据,这个看了答案,不算数