一、简介

本项目是对论文《Stock Trading with Recurrent Reinforcement Learning (RRL)》的代码重现。

论文URL:http://cs229.stanford.edu/proj2006/Molina-StockTradingWithRecurrentReinforcementLearning.pdf

二、结论

先看结论吧:

这种方法的主要困难在于某些股票事件没有显示结构。从上面的第二个示例中可以看出,强化学习者无法预测股价的急剧下跌,并且像人类一样脆弱。如果与预测这种急剧下降的机制结合使用,可能会更有效。该模型还可以在其他方面作出修改,比如将成交量包含进来,作为预测涨跌的特征。

另外,可以尝试使用固定交易成本以及降低交易频率。例如,可以创建一个模型,该模型从长时间的数据中学习,但只能定期做出决策。这将反映一个散户交易者以固定交易成本参与较小数量交易的情况。因为对于散户而言,以固定的交易成本在每个期间进行交易都太昂贵了,所以具有定期交易策略的模型对于此类用户更为可行。

三、小知识

1.Sharp夏普比率的计算方法

四、代码

# -*- coding: utf-8 -*-

import time

import pickle

import numpy as np

import pandas as pd

from datetime import datetime as dt

import matplotlib.pyplot as plt

def main():

fname = "../data/USDJPY30.csv"

init_t = 6000

T = 1000

M = 200

mu = 10000

sigma = 0.04

rho = 1.0

n_epoch = 10000

# RRL agent with initial weight.

ini_rrl = TradingRRL(T, M, init_t, mu, sigma, rho, n_epoch)

ini_rrl.load_csv(fname)

ini_rrl.set_t_p_r()

ini_rrl.calc_dSdw()

# RRL agent for training

rrl = TradingRRL(T, M, init_t, mu, sigma, rho, n_epoch)

rrl.all_t = ini_rrl.all_t

rrl.all_p = ini_rrl.all_p

rrl.set_t_p_r()

rrl.fit()

# Plot results.

# Training for initial term T.

plt.plot(range(len(rrl.epoch_S)),rrl.epoch_S)

plt.title("Sharp's ratio optimization")

plt.xlabel("Epoch times")

plt.ylabel("Sharp's ratio")

plt.grid(True)

plt.savefig("sharp's ratio optimization.png", dpi=300)

plt.close

fig, ax = plt.subplots(nrows=3, figsize=(15, 10))

t = np.linspace(1, rrl.T, rrl.T)[::-1]

ax[0].plot(t, rrl.p[:rrl.T])

ax[0].set_xlabel("time")

ax[0].set_ylabel("USDJPY")

ax[0].grid(True)

ax[1].plot(t, ini_rrl.F[:rrl.T], color="blue", label="With initial weights")

ax[1].plot(t, rrl.F[:rrl.T], color="red", label="With optimized weights")

ax[1].set_xlabel("time")

ax[1].set_ylabel("F")

ax[1].legend(loc="upper left")

ax[1].grid(True)

ax[2].plot(t, ini_rrl.sumR, color="blue", label="With initial weights")

ax[2].plot(t, rrl.sumR, color="red", label="With optimized weights")

ax[2].set_xlabel("time")

ax[2].set_ylabel("Sum of reward[yen]")

ax[2].legend(loc="upper left")

ax[2].grid(True)

plt.savefig("rrl_train.png", dpi=300)

fig.clear()

# Prediction for next term T with optimized weight.

# RRL agent with initial weight.

ini_rrl_f = TradingRRL(T, M, init_t-T, mu, sigma, rho, n_epoch)

ini_rrl_f.all_t = ini_rrl.all_t

ini_rrl_f.all_p = ini_rrl.all_p

ini_rrl_f.set_t_p_r()

ini_rrl_f.calc_dSdw()

# RRL agent with optimized weight.

rrl_f = TradingRRL(T, M, init_t-T, mu, sigma, rho, n_epoch)

rrl_f.all_t = ini_rrl.all_t

rrl_f.all_p = ini_rrl.all_p

rrl_f.set_t_p_r()

rrl_f.w = rrl.w

rrl_f.calc_dSdw()

fig, ax = plt.subplots(nrows=3, figsize=(15, 10))

t_f = np.linspace(rrl.T+1, rrl.T+rrl.T, rrl.T)[::-1]

ax[0].plot(t_f, rrl_f.p[:rrl_f.T])

ax[0].set_xlabel("time")

ax[0].set_ylabel("USDJPY")

ax[0].grid(True)

ax[1].plot(t_f, ini_rrl_f.F[:rrl_f.T], color="blue", label="With initial weights")

ax[1].plot(t_f, rrl_f.F[:rrl_f.T], color="red", label="With optimized weights")

ax[1].set_xlabel("time")

ax[1].set_ylabel("F")

ax[1].legend(loc="lower right")

ax[1].grid(True)

ax[2].plot(t_f, ini_rrl_f.sumR, color="blue", label="With initial weights")

ax[2].plot(t_f, rrl_f.sumR, color="red", label="With optimized weights")

ax[2].set_xlabel("time")

ax[2].set_ylabel("Sum of reward[yen]")

ax[2].legend(loc="lower right")

ax[2].grid(True)

plt.savefig("rrl_prediction.png", dpi=300)

fig.clear()

class TradingRRL(object):

def __init__(self, T=1000, M=200, init_t=10000, mu=10000, sigma=0.04, rho=1.0, n_epoch=10000):

self.T = T

self.M = M

self.init_t = init_t

self.mu = mu

self.sigma = sigma

self.rho = rho

self.all_t = None

self.all_p = None

self.t = None

self.p = None

self.r = None

self.x = np.zeros([T, M+2])

self.F = np.zeros(T+1)

self.R = np.zeros(T)

self.w = np.ones(M+2)

self.w_opt = np.ones(M+2)

self.epoch_S = np.empty(0)

self.n_epoch = n_epoch

self.progress_period = 100

self.q_threshold = 0.7

def load_csv(self, fname):

tmp = pd.read_csv(fname, header=None)

tmp_tstr = tmp[0] +" " + tmp[1]

tmp_t = [dt.strptime(tmp_tstr[i], '%Y.%m.%d %H:%M') for i in range(len(tmp_tstr))]

tmp_p = list(tmp[5])

self.all_t = np.array(tmp_t[::-1])

self.all_p = np.array(tmp_p[::-1])

def quant(self, f):

fc = f.copy()

fc[np.where(np.abs(fc) < self.q_threshold)] = 0

return np.sign(fc)

def set_t_p_r(self):

self.t = self.all_t[self.init_t:self.init_t+self.T+self.M+1]

self.p = self.all_p[self.init_t:self.init_t+self.T+self.M+1]

self.r = -np.diff(self.p)

def set_x_F(self):

for i in range(self.T-1, -1 ,-1):

self.x[i] = np.zeros(self.M+2)

self.x[i][0] = 1.0

self.x[i][self.M+2-1] = self.F[i+1]

for j in range(1, self.M+2-1, 1):

self.x[i][j] = self.r[i+j-1]

self.F[i] = np.tanh(np.dot(self.w, self.x[i]))

def calc_R(self):

self.R = self.mu * (self.F[1:] * self.r[:self.T] - self.sigma * np.abs(-np.diff(self.F)))

def calc_sumR(self):

self.sumR = np.cumsum(self.R[::-1])[::-1]

self.sumR2 = np.cumsum((self.R**2)[::-1])[::-1]

def calc_dSdw(self):

self.set_x_F()

self.calc_R()

self.calc_sumR()

self.A = self.sumR[0] / self.T

self.B = self.sumR2[0] / self.T

self.S = self.A / np.sqrt(self.B - self.A**2)

self.dSdA = self.S * (1 + self.S**2) / self.A

self.dSdB = -self.S**3 / 2 / self.A**2

self.dAdR = 1.0 / self.T

self.dBdR = 2.0 / self.T * self.R

self.dRdF = -self.mu * self.sigma * np.sign(-np.diff(self.F))

self.dRdFp = self.mu * self.r[:self.T] + self.mu * self.sigma * np.sign(-np.diff(self.F))

self.dFdw = np.zeros(self.M+2)

self.dFpdw = np.zeros(self.M+2)

self.dSdw = np.zeros(self.M+2)

for i in range(self.T-1, -1 ,-1):

if i != self.T-1:

self.dFpdw = self.dFdw.copy()

self.dFdw = (1 - self.F[i]**2) * (self.x[i] + self.w[self.M+2-1] * self.dFpdw)

self.dSdw += (self.dSdA * self.dAdR + self.dSdB * self.dBdR[i]) * (self.dRdF[i] * self.dFdw + self.dRdFp[i] * self.dFpdw)

def update_w(self):

self.w += self.rho * self.dSdw

def fit(self):

pre_epoch_times = len(self.epoch_S)

self.calc_dSdw()

print("Epoch loop start. Initial sharp's ratio is " + str(self.S) + ".")

self.S_opt = self.S

tic = time.clock()

for e_index in range(self.n_epoch):

self.calc_dSdw()

if self.S > self.S_opt:

self.S_opt = self.S

self.w_opt = self.w.copy()

self.epoch_S = np.append(self.epoch_S, self.S)

self.update_w()

if e_index % self.progress_period == self.progress_period-1:

toc = time.clock()

print("Epoch: " + str(e_index + pre_epoch_times + 1) + "/" + str(self.n_epoch + pre_epoch_times) +". Shape's ratio: " + str(self.S) + ". Elapsed time: " + str(toc-tic) + " sec.")

toc = time.clock()

print("Epoch: " + str(e_index + pre_epoch_times + 1) + "/" + str(self.n_epoch + pre_epoch_times) +". Shape's ratio: " + str(self.S) + ". Elapsed time: " + str(toc-tic) + " sec.")

self.w = self.w_opt.copy()

self.calc_dSdw()

print("Epoch loop end. Optimized sharp's ratio is " + str(self.S_opt) + ".")

def save_weight(self):

pd.DataFrame(self.w).to_csv("w.csv", header=False, index=False)

pd.DataFrame(self.epoch_S).to_csv("epoch_S.csv", header=False, index=False)

def load_weight(self):

tmp = pd.read_csv("w.csv", header=None)

self.w = tmp.T.values[0]

def plot_hist(n_tick, R):

rnge = max(R) - min(R)

tick = rnge / n_tick

tick_min = [min(R) - tick * 0.5 + i * tick for i in range(n_tick)]

tick_max = [min(R) + tick * 0.5 + i * tick for i in range(n_tick)]

tick_center = [min(R) + i * tick for i in range(n_tick)]

tick_val = [0.0] * n_tick

for i in range(n_tick ):

tick_val[i] = len(set(np.where(tick_min[i] < np.array(R))[0].tolist()).intersection(np.where(np.array(R) <= tick_max[i])[0]))

plt.bar(tick_center, tick_val, width=tick)

plt.grid()

plt.show()

if __name__ == "__main__":

main()

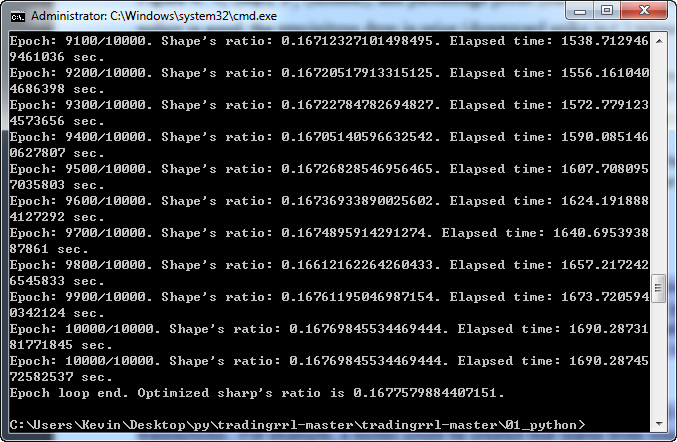

运行截图:

可参考:

https://zhuanlan.zhihu.com/p/36632686

代码地址:https://github.com/darden1/tradingrrl