一、图表

1.图表类型

import matplotlib.pyplot as plt plt.hist() #频数直方图 plt.plot() #线图,传入序列,元组、列表、numpy.ndarray plt.pie() plt.bar() plt.show() plt.scatter()

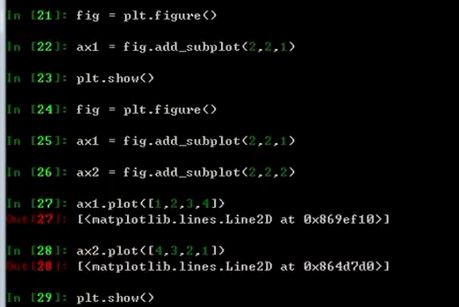

2.画图

fig = plt.figure() 创建一块画布 #将fig分成2*2,1表示是第一个图 ax1 = fig.add_subplot(2,2,1)

二、双均线策略

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

df = pd.read_csv('601318.csv', index_col='date', parse_dates=['date'])

df['ma5'] = np.nan

df['ma10'] = np.nan

# 第一步计算ma

# 循环计算,速度非常慢

#df.loc只能传行或列的名进去,loc左边是行,右边是列

# for i in range(4, len(df)):

# df.loc[df.index[i], 'ma5'] = df['close'][i-4:i+1].mean()

# for i in range(9, len(df)):

# df.loc[df.index[i], 'ma10'] = df['close'][i-9:i+1].mean()

# 方案2:cumsum

# close = [10, 11, 12, 13, 14, 15, 16]

# close.cumsum=[10, 21, 33, 46, 60, 75, 91]

# - - -

# [nan,nan,nan,nan,0, 10, 21, 33, 46, 60, 75, 91]

# sr = df['close'].cumsum()

# df['ma5'] = (sr - sr.shift(1).fillna(0).shift(4))/5

# df['ma10'] = (sr - sr.shift(1).fillna(0).shift(9))/10

# 方案3:rolling

df['ma5'] = df['close'].rolling(5).mean()

df['ma10'] = df['close'].rolling(10).mean()

df = df.dropna()

df[['ma5', 'ma10']].plot()

plt.show()

# 第二部 判断金叉死叉

# 方案一

# 金叉 短期<=长期 短期>长期

# 死叉 短期>=长期 短期<长期

# sr = df['ma5'] <= df['ma10']

#

# golden_cross = []

# death_cross = []

# for i in range(1, len(sr)):

# # if sr.iloc[i] == True and sr.iloc[i + 1] == False: 开始想的是加1,但是索引溢出

# if sr.iloc[i - 1] == True and sr.iloc[i] == False:

# golden_cross.append(sr.index[i])

# if sr.iloc[i - 1] == False and sr.iloc[i] == True:

# death_cross.append(sr.index[i])

# 方案2

golden_cross = df[(df['ma5'] <= df['ma10']) & (df['ma5'] > df['ma10']).shift(1)].index

death_cross = df[(df['ma5'] >= df['ma10']) & (df['ma5'] < df['ma10']).shift(1)].index

三、一个简单的回测框架

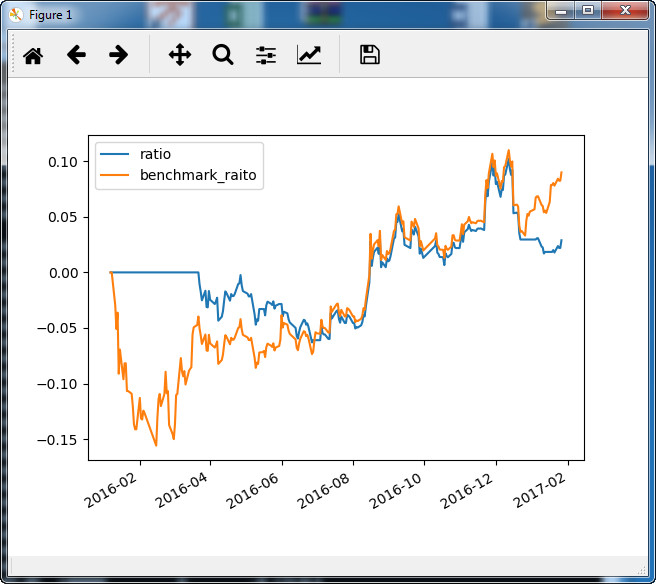

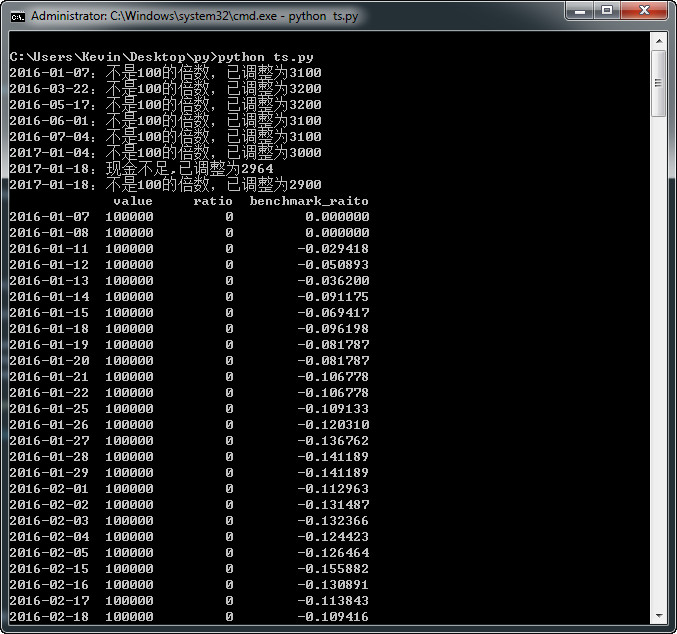

成果展示:

代码:

import pandas as pd

import matplotlib.pyplot as plt

import tushare

import datetime

import dateutil

'''

获取所有的股票交易日,交易日信息保存在csv文件

'''

try:

trade_cal = pd.read_csv("trade_cal.csv")

except:

trade_cal = tushare.trade_cal()

trade_cal.to_csv("trade_cal.csv")

class Context:

def __init__(self, cash, start_date, end_date):

'''

保存股票信息

:param cash: 现金量

:param start_date: 量化策略开始时间

:param end_date: 量化策略结束时间

:param positions: 持仓股票和对应的数量

:param benchmark: 参考股票

:param date_range: 开始-结束之间的所有交易日

:param dt: 当前日期 (循环时当前日期会发生变化)

'''

self.cash = cash

self.start_date = start_date

self.end_date = end_date

self.positions = {} # 持仓信息

self.benchmark = None

self.date_range = trade_cal[(trade_cal['isOpen']==1)&

(trade_cal['calendarDate']>=start_date)&

(trade_cal['calendarDate']<=end_date)]['calendarDate'].values

self.dt = None

class G:

'''

保存用户的全局参数

'''

pass

'''

默认的初始化信息

'''

g = G()

CASH = 100000

START_DATE = '2016-01-07'

END_DATE = '2017-01-31'

context = Context(CASH,START_DATE,END_DATE)

def attribute_history(security,

count,

field=('open','close','high','low','volume')):

'''

获取某股票count天的历史行情,每运行一次该函数,日期范围后移

:param security: 股票代码

:param count: 天数

:param field: 字段

:return:

'''

end_date = (context.dt - datetime.timedelta(days=1)).strftime('%Y-%m-%d')

start_date = trade_cal[(trade_cal['isOpen']==1)&

(trade_cal['calendarDate']<=end_date)][-count:]['calendarDate'].iloc[0]

return attribute_daterange_history(security,start_date,end_date,field)

def attribute_daterange_history(security,

start_date,end_date,

field=('open','close','high','low','volume')):

'''

底层,获取某股票某一段时间的历史行情

:param security:

:param start_date:

:param end_date:

:param field:

:return:

'''

df = tushare.get_k_data(security,start_date,end_date)

df.index = df['date']

return df[list(field)]

def get_today_data(security):

'''

获取context的"当天"的股票信息,停牌返回Null

:param security:

:return:

'''

try:

today = context.dt.strftime('%Y-%m-%d')

df = tushare.get_k_data(security,today,today)

df.index = df['date']

data = df.loc[today]

except KeyError: # 股票停牌

data = pd.Series()

return data

def _order(today_data, security, amount):

'''

底层买股票的函数

:param today_data: "当天"的股票价格OCHL

:param security: 股票代码

:param amount: 交易股数,正数为买入,负数为卖出

:return:

'''

p = today_data['open']

# 找不到该股票默认为0股

old_amount = context.positions.get(security, 0)

if len(today_data) == 0:

print("今日停牌")

return

if context.cash - amount * p < 0:

amount = context.cash // p

print('%s:现金不足,已调整为%d' %(today_data['date'],amount))

if amount % 100 != 0:

# 买或卖不是100的倍数就调整为100的倍数,卖光则不调整

if amount != -old_amount:

# 2345 => 2300

amount = int(amount / 100) * 100

print('%s:不是100的倍数,已调整为%d' %(today_data['date'],amount))

if old_amount < -amount:

amount = -old_amount

print('%s:卖出股票不能超过持仓数,已调整为%d'%(today_data['date'],amount))

# 更新持仓信息

context.positions[security] = old_amount + amount

# 更新钱

context.cash -= amount*p

# 持仓为0就删掉

if context.positions[security] == 0:

del context.positions[security]

def order(security, amount):

# 买入股票。amount为正表示买入,负表示卖出

today_data = get_today_data(security)

_order(today_data, security, amount)

def order_target(security, amount):

# 把股票交易到多少股,不能为负数,比原来小是卖出,比原来大是买入

if amount < 0:

print("数量不能为负,已调整为0")

amount = 0

today_data = get_today_data(security)

hold_amount = context.positions.get(security, 0) # TODO: T + 1 closeable total

delta_amount = amount - hold_amount

_order(today_data,security,delta_amount)

def order_value(security, value):

# 买多少钱的股票或者卖多少钱的股票

today_data = get_today_data(security)

amount = value / today_data['open']

_order(today_data,security,amount)

def order_target_value(security, value):

# 买到或者卖到多少钱

if value < 0:

print("价值不能为负,已调整为0")

value = 0

today_data = get_today_data(security)

hold_value = context.positions.get(security,0) * today_data['open']

dalta_value = value - hold_value

order_value(security,dalta_value)

def run():

plt_df = pd.DataFrame(index=pd.to_datetime(context.date_range),

columns=['value'])

# 最初的钱,算收益率用

init_value = context.cash

# 保存停牌前一天的股票价格

last_price = {}

# 用户接口1

initialize(context)

for dt in context.date_range:

context.dt = dateutil.parser.parse(dt)

# 用户接口2

handle_data(context)

# 股票和现金的总价值

value = context.cash

for stock in context.positions:

# 考虑停牌的情况

today_data = get_today_data(stock)

if len(today_data) == 0:

p = last_price[stock]

else:

p = today_data['open']

last_price[stock] = p

value += p * context.positions[stock]

plt_df.loc[dt, 'value'] = value

plt_df['ratio'] = (plt_df['value']-init_value) / init_value

bm_df = attribute_daterange_history(context.benchmark,

context.start_date,

context.end_date)

bm_init = bm_df['open'][0]

plt_df['benchmark_raito'] = (bm_df['open']-bm_init) / bm_init

print(plt_df)

plt_df[['ratio','benchmark_raito']].plot()

plt.show()

'''

initialize和handle_data是用户的操作

'''

def initialize(context):

context.benchmark = '601318'

g.p1 = 5

g.p2 = 60

g.security = '601318'

def handle_data(context):

hist = attribute_history(g.security, g.p2)

ma5 = hist['close'][-g.p1:].mean()

ma60 = hist['close'].mean()

if ma5 > ma60 and g.security not in context.positions:

order_value(g.security, context.cash)

elif ma5 < ma60 and g.security in context.positions:

order_target(g.security,0)

if __name__ == '__main__':

run()

相关说明:

tushare.trade_cal() # 获取交易日信息,输出结果为:

calendarDate isOpen

0 1990/12/19 1

1 1990/12/20 1

2 1990/12/21 1

3 1990/12/22 0

4 1990/12/23 0

5 1990/12/24 1

6 1990/12/25 1

7 1990/12/26 1

8 1990/12/27 1

9 1990/12/28 1

10 1990/12/29 0

11 1990/12/30 0

12 1990/12/31 1

13 1991/1/1 0